If Cinderella Happened Today, What Would Happen to Her Inheritance Under Nebraska Law?

In Nebraska blended families, “good intentions” are not a legal plan. If you die without a will or trust, stepchildren may not inherit at all, while a surviving spouse can have strong statutory rights that reshape who receives what. This Cinderella-inspired guide explains how Nebraska intestacy, the elective share, and key spouse allowances can affect second marriages—and how a well-built trust-based plan can protect your kids without setting your spouse up to fail.

What Is an Estate Plan, and Why Does Every Adult Need One?

Estate planning is about more than passing on assets—it’s about protecting your family and your voice. At Zachary W. Anderson Law, we help individuals and families in Lincoln and across Nebraska create clear, legally sound estate plans that work when life takes an unexpected turn. From Wills and Trusts to Powers of Attorney and Living Wills, we focus on giving you control, reducing court involvement, and making sure the people you trust can act for you when it matters most.

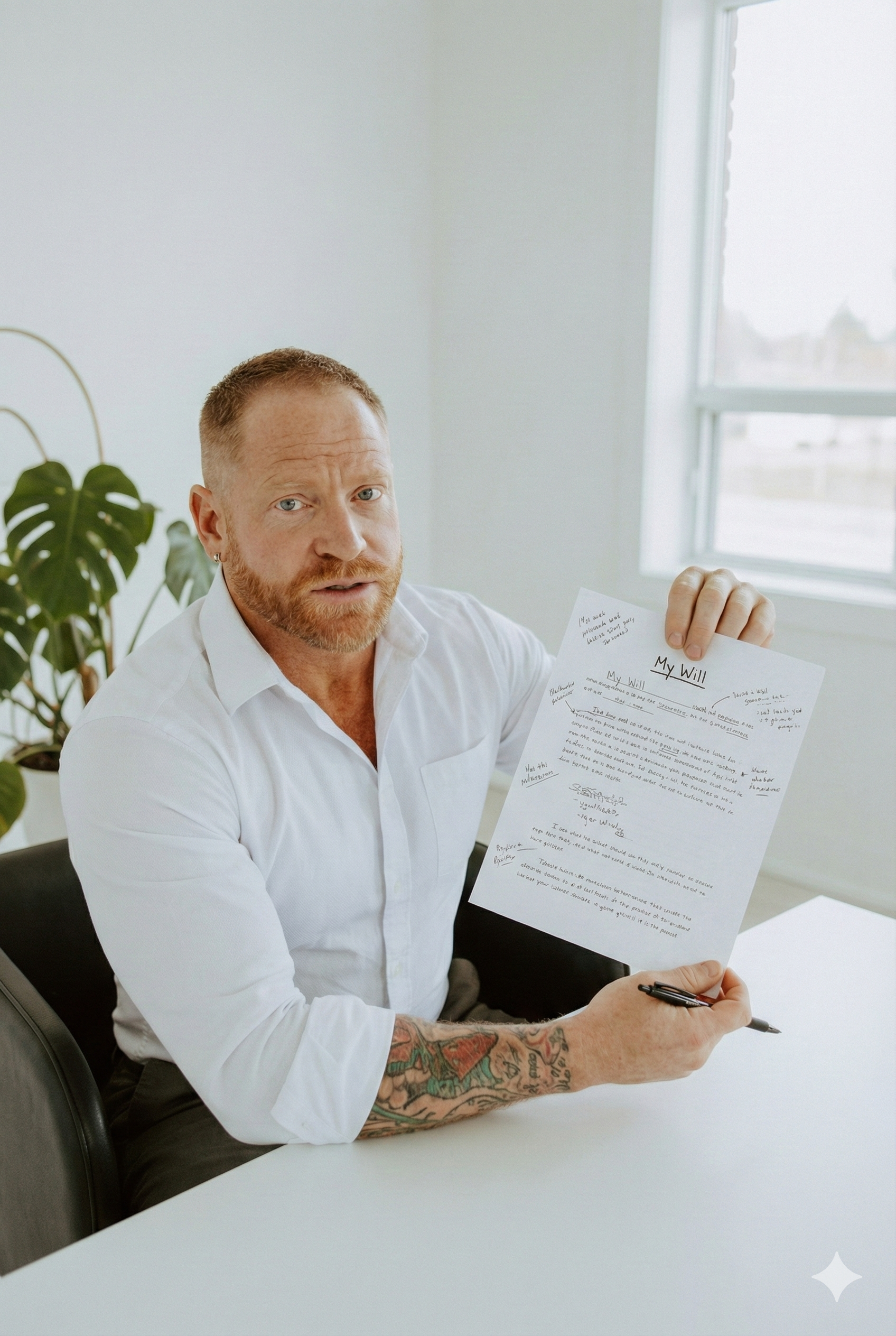

Are Handwritten “Napkin Wills,” Text Messages, or DIY Wills Actually Valid in Nebraska?

Many Nebraska families assume a handwritten note, text message, or video will control what happens after death. In reality, Nebraska probate law is strict about what counts as a valid will, and informal “napkin wills” often fail. This article explains when handwritten wills work, why DIY documents cause disputes, and how to protect your family from unnecessary probate fights.

What Can Stranger Things Teach Us About Guardianship and Child Custody in Nebraska?

Why Stranger Things Is a Surprisingly Good Guide to Nebraska Guardianship Law. What happens when parents can’t safely care for a child? Using Eleven’s story as a real-world lens, this article explains how Nebraska courts handle guardianship, non-parent custody, and the “best interests of the child” standard, including recent law changes that affect who can serve as a guardian. A practical, Nebraska-specific guide for families planning ahead or facing a crisis.

Why is relying on the State to be your “emergency contact” in Nebraska such a HUGE risk?

Most people assume the state will step in if they lose capacity without a plan. In Nebraska, that assumption is risky. The Office of Public Guardian was nominated 124 times in one year and accepted only two cases. That reality changes everything about how families should think about powers of attorney, guardianship, and planning ahead. This post breaks down why relying on a “safety net” isn’t a plan, how recent Nebraska law has made guardianship more complicated, and what you can do now to stay in control and keep your family out of crisis court.

What Happens If My Unmarried Partner Dies Without a Will in Nebraska?

If your unmarried partner dies without a will in Nebraska, the law does not treat you as an heir or default decision-maker. Assets typically pass to parents, siblings, or children, not to a long-term partner. This article explains how Nebraska intestacy and medical decision-making laws actually work, the risks unmarried couples face, and how the right estate planning documents can protect the person you love.

Can One Outdated Beneficiary Form Wreck an Otherwise Good Nebraska Estate Plan?

Beneficiary designations often control more of your estate than your will. In Nebraska, retirement accounts, life insurance, and certain bank or investment accounts pass by contract, which means outdated forms can undermine even careful planning. This post walks through the most common mistakes, the divorce-related legal nuances that trip people up, and how to make sure your estate plan actually works when it matters.

Why Does a “Perfect” Estate Plan Still Tear Families Apart?

Even well-drafted wills and trusts can leave families fighting. In my Lincoln practice, I see conflict arise when plans ignore real-world dynamics, undocumented gifts, and personal property. Nebraska law enforces what’s written, not what was meant—and that gap is where families fracture.

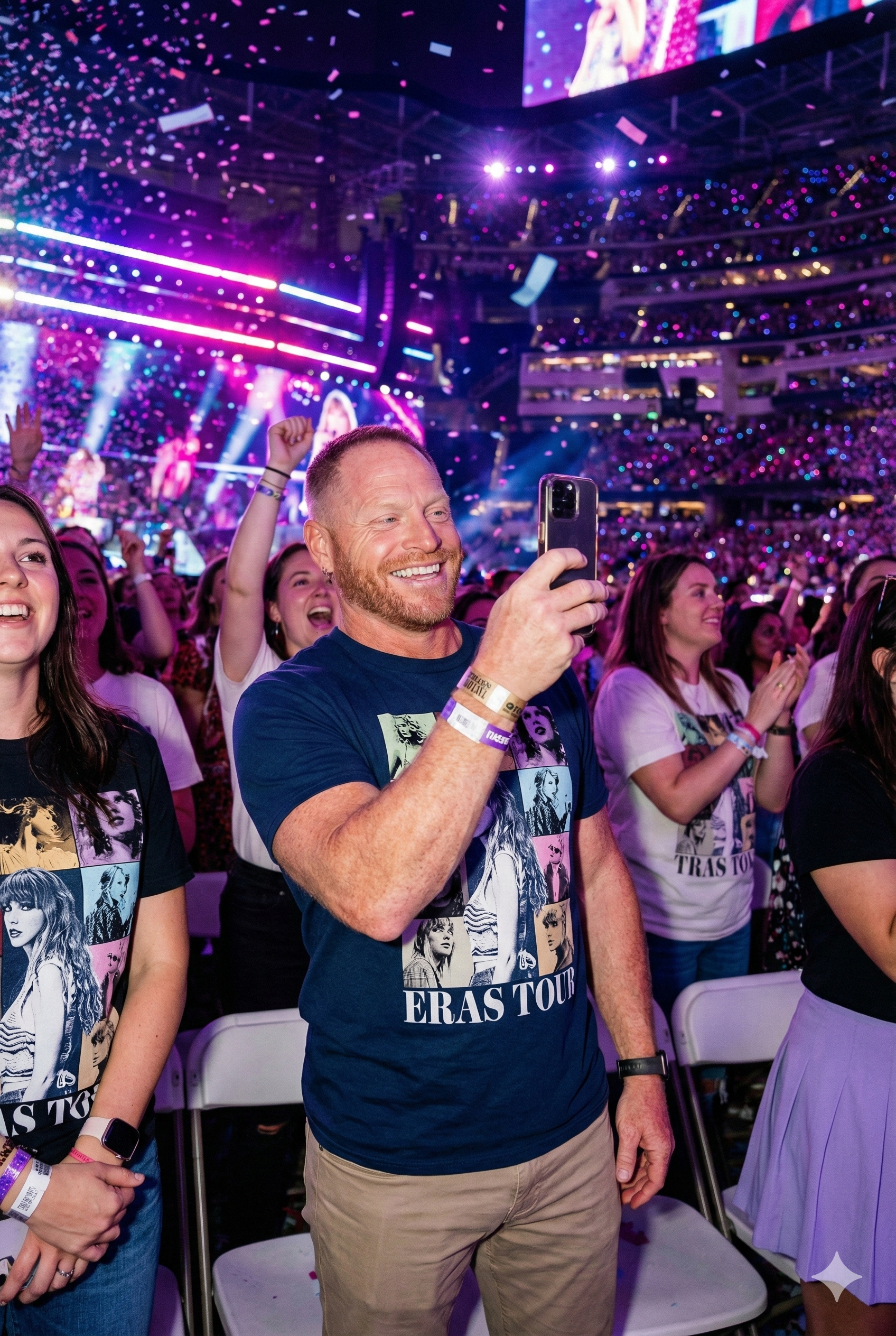

What Taylor Swift’s Airtight Estate Planning Can Teach the Rest of Us (Yes, Even in Nebraska)

Taylor Swift didn’t avoid legal chaos by luck. She avoided it through intentional estate planning. This post explains how clear documents, limited authority, and early planning can keep families out of court—and why those same lessons matter just as much for everyday Nebraskans.

Do College Athletes Need an Estate Plan? The Legal Reality of NIL in Nebraska

Do college athletes with NIL deals really need an estate plan? In Nebraska, the answer is often yes. Student-athletes can earn real income through Name, Image, and Likeness (NIL) agreements, but state-specific laws create legal gaps many families don’t expect. Nebraska’s age-19 rule, limits on how long NIL contracts can last, and strict rules around digital assets mean that default law may leave no one with authority to manage contracts, income, or medical decisions in a crisis. This article explains why estate planning has become a critical piece of NIL and how Nebraska student-athletes can protect what they’re building.

Do Fonts and Formatting Really Matter in a Nebraska Will?

Nebraska law doesn’t require a specific font for a valid will—but that doesn’t mean formatting is irrelevant. In real probate cases, wills are scanned, copied, and relied on by clerks, courts, and families under stress. Poor readability, cramped margins, or handwritten changes can create confusion, delay probate, or spark disputes, even when a will is technically valid. This article explains what Nebraska law actually requires, why “boring” formatting is often the safest choice, and how simple layout decisions can help your estate plan hold up in the real world.

How Do You Protect Your Pets If Something Happens to You in Nebraska?

Planning for your pets isn’t just sentimental—it’s a real legal issue in Nebraska. Because pets are treated as property under state law, they aren’t automatically protected if you’re hospitalized or pass away. A Will alone won’t cover them during an emergency, and leaving money “to” a pet isn’t legally possible. The good news is Nebraska law gives you strong tools, including Pet Trusts under Neb. Rev. Stat. § 30-3834, to make sure your animals are cared for exactly the way you intend. With the right mix of a Power of Attorney, a Will or Trust, and clear care instructions, you can prevent your pets from ending up in a shelter and give your caregiver everything they need to step in confidently when life doesn’t go according to plan.

Should You Use a Codicil or Create a New Will in Nebraska?

Updating your will isn’t always straightforward, and many people in Nebraska aren’t sure whether they should add a codicil or start fresh with a new will. While a codicil can handle small updates like replacing an executor or correcting basic information, bigger changes—like adding children, removing a beneficiary, or updating how major assets are distributed—are usually better handled with a new will. Nebraska law requires codicils to follow the same signing and witnessing formalities as a will, so “quick fixes” can backfire if the change affects your overall plan. A clean, updated will is often the best way to avoid confusion, prevent probate delays, and ensure your wishes are honored.

What estate planning does the Venmo generation actually need?

Estate planning isn’t just for retirees anymore. If you live in Nebraska and use Venmo, Cash App, crypto, Robinhood, or online banking, you already have an estate—and those digital accounts can be locked forever if something happens to you. This guide breaks down how Nebraska law treats your digital assets, why partners get nothing without a will, and the simple steps millennials and Gen Z can take to protect their money, passwords, and online life.

Why Thanksgiving Is the Best Time to Talk Estate Planning (And How to Do It Without Ruining Dinner)

Thanksgiving is one of the most natural moments to start an estate planning conversation because the people who matter most are finally in the same room. Families are already thinking about connection, care, and the future, which makes it easier to talk about wills, powers of attorney, guardianship for minor children, and what should happen if someone becomes seriously ill. Most Americans still don’t have a basic plan in place, leaving loved ones vulnerable to Nebraska’s default rules and probate delays. A calm, values-focused conversation at Thanksgiving can prevent confusion later and give everyone the clarity they need to support each other. This guide explains why the holiday works so well, how to bring it up without killing the mood, and what documents most Nebraska families should have.

What Are the 5 Apps That Could Secretly Lock Your Family Out of $100K+?

Most Nebraskans don’t realize how much of their wealth now lives inside apps—crypto wallets, Robinhood, Venmo, Stripe, and even the password managers that control them. These tools work well while you’re alive, but they can turn into sealed vaults the moment you die. Nebraska’s RUFADAA law gives your Personal Representative (Executor) a path to access these accounts, but only if your estate plan explicitly grants that authority. Without it, even $50,000–$100,000 sitting in an app can get locked away for good. This guide breaks down the five types of apps most likely to trap your money and explains how a Digital Access Plan can protect your family from a long, expensive probate.

Bank or Brother-in-Law: Who Should You Put in Charge of Your Nebraska Estate Plan?

Choosing who will manage your estate is one of the most personal decisions in planning for the future. For some Nebraska families, naming a relative works perfectly. For others—especially where there’s conflict, blended families, or complex assets—a corporate fiduciary like a bank or trust company can provide the neutrality and professional oversight that keeps things running smoothly. In my practice, I help clients weigh the pros and cons of each option, understand how Nebraska law protects them, and build estate plans that reduce stress, prevent disputes, and honor their long-term goals. If you’re unsure whether a family member or a corporate fiduciary is the right fit, this guide walks you through what you need to know.

What Is Día de las Mascotas Muertas — and How Can Nebraska Pet Owners Honor Their Pets’ Legacies?

Día de las Mascotas Muertas — the “Day of the Dead for Pets” — is celebrated on October 27 to honor the lives of beloved animals who’ve passed away. Families build small altars with photos, toys, and marigolds to welcome their pets’ spirits home, creating a touching space for remembrance and healing. This tradition also highlights an important legal truth for Nebraska pet owners: you can include your pets in your estate plan through a will or pet trust, ensuring their care continues no matter what. Learn how this beautiful day of remembrance connects culture, love, and practical planning for your four-legged family members.

What Happens to Your Estate Plan After Divorce in Nebraska?

Divorce changes everything—including your estate plan. Many people don’t realize that while Nebraska law automatically removes an ex-spouse from a will, it doesn’t affect life insurance, 401(k)s, or other beneficiary designations. That means your ex could still inherit your assets if you don’t update your paperwork. This post explains how Nebraska law treats wills, trusts, and non-probate assets after divorce, why ERISA plans are the biggest “gotcha,” and the key steps to protect your legacy and avoid costly mistakes.

Divorce After Retirement in Nebraska

Divorce after retirement—often called gray divorce—is becoming more common among Nebraska couples in their 50s, 60s, and beyond. When a long marriage ends later in life, it raises complex questions about dividing retirement accounts, setting alimony, and updating estate plans. Learn how Nebraska courts handle these issues, what happens to pensions and health coverage, and why revising your will and beneficiaries is critical.

Want to stay in the loop without checking back every week?

You can subscribe to updates from my blog using RSS. It’s an easy way to get new posts in your favorite app—no social media or email required.

Here’s the link to subscribe:

https://www.zandersonlaw.com/blog?format=rss

You can paste that into a feed reader like Feedly, Inoreader, or even some email clients.

Not sure what RSS is?

It’s kind of like subscribing to a news feed—just for this blog.

You’ll automatically see new articles when they’re posted, without needing to follow or sign up for anything else.

Please note:

The content on this blog is for general informational purposes only and is not legal advice.

Reading it does not create an attorney-client relationship.

For personalized guidance tailored to your specific circumstances,

it's always best to connect with a qualified attorney.